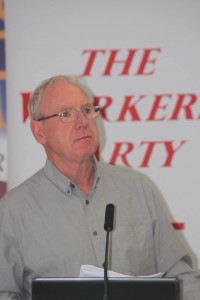

Cork Workers’ Party councillor Ted Tynan has accused the Bank of Ireland of introducing an apartheid banking system which would see its counter services all but closed off to working class people.

Cllr. Tynan said the bank’s decision to ban counter withdrawals of less than €700 and lodgements under €3,000 was a massive slap in the face for the ordinary people who were mugged by the state in order to save the Bank of Ireland and its counterparts from oblivion. He has called on the government to force the Bank of Ireland to reverse its decision.

“It is only six years ago since the Irish taxpayers bailed out Bank of Ireland to the tune of €3 billion euro. Instead of this the bank and its counterparts should have been allowed go to the wall and be replaced by a state bank. It was nursed back to profitability with massive state subsidies paid for by working class people in the main.

“The thanks for all of this has been for Bank of Ireland to abandon these very customers with widespread branch closures especially in working class areas. In my own area we have lost all local bank branches in the Mayfield area over the past few years while ATMs in shops are often empty or out of action which may leave people without money for basics like food or to top up fuel or phone cards over a weekend“

“This will have a huge effect on elderly people and those on low incomes who having being forced by banks and the state to accept payments directly into their accounts and who will now face difficulties drawing their money out.” Cllr. Tynan said €700 was a huge sum for most working class people and especially pensioners and those dependent on social welfare while a €3,000 withdrawal might be a once in a lifetime event. “What planet are those who make such decisions living on?” queried Cllr. Tynan.

The Workers’ Party councillor has called on the government to use all its powers to prevent this decision being implemented and said that bank customers should vote with their feet by transferring their accounts to the post office or credit unions